Does Tire Agent check credit? Yes, Tire Agent may check your credit when you apply for financing options. This helps them determine your eligibility for payment plans or credit-based offers.

Purchasing new tires can be an essential but expensive part of car ownership. For many individuals, affording a large sum upfront may not always be feasible. Whether you are looking to replace your tires due to wear and tear, or need them because of seasonal changes, knowing the financing options can make the entire process more manageable.

Tire Agent offers a solution for customers who want to finance their tire purchases without the burden of traditional credit checks. But does Tire Agent check your credit before approving a financing option? Let’s break down what Tire Agent offers and whether credit checks are a part of the equation.

Contents

Tire Agent’s Financing Options

Tire Agent provides various financing plans for customers who want to purchase tires with flexible payment options. These options include a variety of lease-to-own programs that allow customers to pay for their tires over time, without needing to pay for them all at once.

Tire Agent’s financing services are especially appealing to those with less-than-ideal credit or even no credit history at all. One of the most significant features of Tire Agent’s financing is that many of their programs do not require a traditional credit check. But how exactly does this work? Let’s take a look at the different financing options offered by Tire Agent and whether credit checks are involved.

Key Financing Options Provided by Tire Agent

Tire Agent offers several ways to pay for your tires over time. Some of these options involve a soft credit inquiry, while others do not involve a credit check at all. Let’s explore the major financing platforms provided by Tire Agent.

PayPair Platform: Financing with Flexible Terms

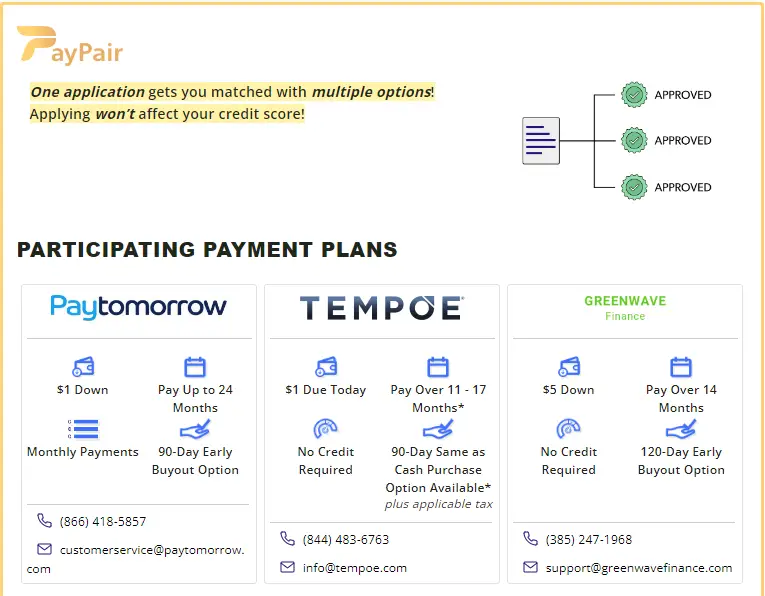

One of the core services provided by Tire Agent is the PayPair platform, which connects customers to a network of lenders. Through this platform, customers can apply for tire financing with terms that suit their budget.

- No Traditional Credit Checks: Unlike many traditional lenders who perform hard credit checks, the PayPair platform does not require a hard credit inquiry, making it easier for individuals with poor or no credit to get approved. Instead, PayPair uses other criteria such as income, employment status, and banking history to assess an applicant’s ability to repay.

- Soft Credit Pull: While PayPair does not conduct a traditional credit check, a soft credit pull may still be performed. This type of inquiry does not impact your credit score, and it is typically used to gather basic information to assess your eligibility for financing.

Pros of PayPair:

- Easy to apply for, with a simple online application.

- Flexible payment terms.

- Soft credit inquiry, which won’t affect your credit score.

UOwn Leasing: No Credit Score Needed

UOwn Leasing is a lease-to-own option available through Tire Agent. This financing program is designed to help people who might not have access to traditional credit-based loans.

- No Credit Score Required: UOwn Leasing is unique in that it does not require a credit score to apply. This is especially beneficial for people with no credit history or those who may have a low score.

- Soft Credit Inquiry: UOwn Leasing performs a soft credit check to verify basic information about your financial situation. However, this won’t affect your credit score.

- Flexible Payment Plans: Once approved, customers can choose between a variety of payment plans, such as weekly, bi-weekly, semi-monthly, or monthly payments.

Pros of UOwn Leasing:

- Doesn’t rely on traditional credit scores.

- Soft credit inquiry ensures no negative impact on your credit.

- Multiple payment options for flexibility.

Katapult: Lease-to-Own Option with Flexible Terms

Katapult provides another lease-to-own option through Tire Agent. This program is tailored to individuals with poor or no credit.

- Soft Credit Check: Katapult performs a soft credit check, so your credit score remains unaffected. This makes it accessible to a broad range of applicants, including those with poor credit.

- No Credit History Required: If you don’t have a credit history or have an imperfect credit score, Katapult considers factors like income and employment status to assess your ability to make payments.

- Payment Flexibility: The lease-to-own program allows you to pay for your tires over time with manageable payment plans.

Pros of Katapult:

- Soft credit check ensures your credit score is not impacted.

- No credit history required to qualify.

- Flexible payment terms.

Snap Finance: Lease-to-Own Financing with No Credit Score

Snap Finance is another popular option for financing through Tire Agent. Snap Finance specializes in providing customers with alternative ways to finance products when they do not have access to traditional credit.

- Soft Credit Pull: Snap Finance performs a soft credit check, which does not affect your credit score. This means that even individuals with poor credit can apply for financing without the worry of hurting their credit.

- Easy Qualification: Instead of relying solely on a credit score, Snap Finance evaluates other factors such as your income and employment history. This makes it possible for those with less-than-ideal credit to still qualify for financing.

- Flexible Terms: Snap Finance provides several payment options, including weekly, bi-weekly, or monthly payments, giving customers the flexibility to choose what works best for their budget.

Pros of Snap Finance:

- Soft credit check means no negative impact on credit score.

- Includes options for those with poor or no credit history.

- Flexible payment plans and terms.

PayTomorrow: Flexible Financing Without Credit History

PayTomorrow is another financing option available through Tire Agent. PayTomorrow is designed to provide customers with the flexibility they need to pay for their tires over time.

- No Credit Score Required: Just like UOwn Leasing, PayTomorrow doesn’t require a credit score to qualify. This makes it an excellent option for individuals who may not have a credit history or have a poor credit score.

- Soft Credit Inquiry: PayTomorrow may perform a soft credit check to gather necessary information, but it will not affect your credit score.

- Flexible Repayment Options: With PayTomorrow, you can choose between various payment terms, including weekly, bi-weekly, or monthly payments, depending on your preferences and budget.

Pros of PayTomorrow:

- No credit score required for approval.

- Soft credit pull ensures there’s no impact on your credit score.

- Various payment options to suit your financial situation.

Why Tire Agent’s Financing is a Game-Changer

Tire Agent’s financing options are designed to be accessible to a wide range of customers, including those with poor or no credit history. Unlike traditional financing options that require high credit scores, Tire Agent makes it possible to buy tires and pay over time, regardless of your credit status.

Here are some of the key benefits of financing your tires through Tire Agent:

- No Traditional Credit Checks: Most of the financing options available through Tire Agent do not require a hard credit inquiry, which is beneficial for people who have low or no credit scores.

- Increased Access to Financing: Whether you have excellent credit, poor credit, or no credit history, Tire Agent’s programs open doors to tire financing for more people.

- Soft Credit Inquiries: If a credit check is required, Tire Agent uses a soft pull, which doesn’t affect your credit score.

- Flexible Payment Plans: With options to pay weekly, bi-weekly, or monthly, customers can choose the repayment schedule that fits their budget.

Frequently Asked Questions

Here are some FAQs about tire agent credit check –

1. Does Tire Agent perform a hard credit check?

No, Tire Agent primarily performs soft credit checks, which do not affect your credit score. This makes it easier for individuals with poor or no credit to access financing options.

2. Can I apply for financing with no credit history?

Yes, Tire Agent’s financing programs, such as UOwn Leasing and PayTomorrow, do not require a credit score or credit history. These programs evaluate applicants based on other factors like income and employment status.

3. What types of payment plans are available?

Tire Agent offers flexible payment options, including weekly, bi-weekly, semi-monthly, and monthly plans, allowing customers to select the schedule that works best for them.

4. Is there an option to buy out the tires early?

Yes, some financing options, such as those offered through Katapult and Snap Finance, provide the option for customers to buy out the tires before the lease term ends, often at a discounted rate.

5. How can I apply for financing through Tire Agent?

You can apply for financing through Tire Agent directly on their website. The application process is simple and requires basic information such as your income and employment status. If a credit check is required, it will typically be a soft credit pull.

Conclusion

Tire Agent’s financing options offer flexibility and inclusivity for customers with various credit backgrounds. By providing several alternative financing plans that don’t rely on traditional credit scores, Tire Agent makes it possible for more individuals to afford the tires they need. Whether you have perfect credit or are rebuilding your score, Tire Agent’s lease-to-own programs give you the chance to finance your tires with manageable terms, without the pressure of a hard credit inquiry.

If you’re considering financing your tire purchase, Tire Agent provides numerous options to help you make an informed decision based on your financial situation. Don’t let credit score worries stop you from purchasing the tires you need—explore the various financing options available through Tire Agent today.